when does draftkings send out 1099|Sports Betting Taxes: How to Handle DraftKings, FanDuel : Clark If you have greater than $600 of net earnings during a calendar year, you can expect to receive an IRS Form 1099-Misc from DraftKings. This form will include all net earnings . 1. 5K Run/Walk. How It Raises Money: Peer-to-peer, Sponsorships, Entry Fee. Cost: Difficulty: Outcome: There’s nothing better than spending a spring or fall morning participating in a 5K or a charity walk.Runners/walkers will need to pay an entry fee, but you can also encourage participants to get sponsorships.

PH0 · Where can I find my DraftKings tax forms / documents (1099/ W

PH1 · Where can I find my DraftKings tax forms / documents (1099/ W

PH2 · What are the 1099

PH3 · Tax Considerations for Fantasy Sports Fans

PH4 · Statements, Taxes and Documents on DraftKings – Overview

PH5 · Statements, Taxes and Documents on DraftKings

PH6 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH7 · Key tax dates for DraftKings

PH8 · How to get and fill in a DraftKings Tax Form 1099

PH9 · How to File Your Taxes If You Bet on Sports: Explained

PH10 · DraftKings Tax Form 1099

PH11 · DraftKings

「eoメール 」にアクセスします。 「 メールアドレス 」と「 メールパスワード 」を入力し、ログインしてください。 eoメールにログインできない場合は、以下をご確認ください。 2段階認証の設定をしていない

when does draftkings send out 1099*******Forms 1099-MISC and Forms W-2G are expected to be available online at the end of January 2024. A separate communication will be sent to players receiving tax forms as they are available for download in the DraftKings Document Center, accessible via the .If you have greater than $600 of net earnings during a calendar year, you .If you qualify to receive tax forms from DraftKings (IRS Forms 1099/W-2G), you .If you have greater than $600 of net earnings during a calendar year, you can expect to receive an IRS Form 1099-Misc from DraftKings. This form will include all net earnings .

If you qualify to receive tax forms from DraftKings (IRS Forms 1099/W-2G), you can access the information directly from the Financial Center. You can expect to receive your tax . If you received other prizes or promotional payouts totaling $600 or more from a platform like DraftKings or FanDuel, you might also receive a 1099 form from the .

This article covers how you get your DraftKings sportsbook tax form in addition to how you fill in your DraftKings tax form. We should mention that most bettors should have received their DraftKings 1099 .

Understanding Taxes on Winnings on DraftKings All winnings from sports betting are subject to federal and state taxes. It’s crucial for players to report and pay .Requirements for Electronic Delivery. You will need to maintain access to your DraftKings account. It will be your responsibility to access the Information Returns before you .Fantasy sports organizers must send both you and the IRS a Form 1099-MISC or 1099-K if you take home a net profit of $600 or more for the year. Fantasy sports organizers use a .The best place to play daily fantasy sports for cash prizes. Make your first deposit!

March 19, 2021, 1:46 AM PDT. How to File Your Taxes If You Bet on Sports: Explained. Sam McQuillan. Reporter. States have collected hundreds of millions in gaming taxes .

Fantasy sports winnings of $600 or more are reported to the IRS. If it turns out to be your lucky day and you take home a net profit of $600 or more for the year playing on websites such as DraftKings and FanDuel, the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC.If you receive your winnings through PayPal, the .

As such, you will not receive any variation of a Form 1099 (e.g., Form 1099-MISC, Form 1099-K, etc.) from FanDuel summarizing your annual wagering activity. What is the Player Activity Statement? The Player Activity Statement is a summary of your FanDuel wallet and gameplay activity.Tap/click Submit My W-9. . Log into the DraftKings Sportsbook or Casino app. Tap your profile photo in the top right corner. Tap Financial Center. Below Tax Center, tap Fill out W9. Below Name and mailing address tap the box .Get insight from other users on your lineups, who you should sub in/sit out, and other information about DraftKings. Members Online • . Does anyone know the time frame of when Draft Kings sends out 1099-Misc forms for winnings? My husband withdrew $539 in winnings but he technically won over $600 so I have a feeling they’ll send us a 1099 .DraftKings Tax Information | Paying Taxes On DraftKings Winnings | 1099 DraftKings | DraftKings Tax Rules | DraftKings 1099 . Gambler Tax Return Preparation . To understand the treatment of gambler taxation, you must know TWELVE BASIC RULES and NINE MYTHS about Gambling. Twelve Rules As a user, DraftKings does send tax forms if you meet certain criteria. They typically issue 1099-MISC forms for users who have won more than $600 during the year. They typically issue 1099-MISC forms for users who have won more than $600 during the .We would like to show you a description here but the site won’t allow us.

You need to win $600 or more on a +30000 odds or greater bet. This isn’t applicable to non sports book activities like fantasy sports, or bingo, etc. The language is out there if you want to do the digging. Of course, a sportsbook could decide to send 1099s out when it isn’t required by law. But why would they do that?to continue to DraftKings Daily Fantasy. Email or Username. Remember my username/email. Password. Forgot Password? Log In. Don't have an account? Sign Up. If you or someone you know has a gambling problem and wants help, call 1-800-GAMBLER. You must be 18+ to play (19+ in AL & NE and 21+ in AZ, IA, LA & MA). Account sharing .

Sports Betting Taxes: How to Handle DraftKings, FanDuel States have collected hundreds of millions in gaming taxes since the Supreme Court overturned the federal ban on sports betting a few years ago, and the IRS wants its fair share. As many as 149 million taxpayers could be on the hook for taxes on legal winnings this tax season, 23 million more than last year. Say you earned $21,000 in 2023. PayPal will send both you and the IRS the same 1099-K form documenting those transactions. {write_off_block} Does the 1099-K include personal PayPal .DraftKings customers in the United States aren't taxed on their withdrawals. Learn more about what is reported to the IRS: Fantasy.

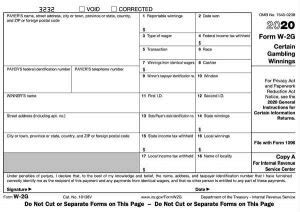

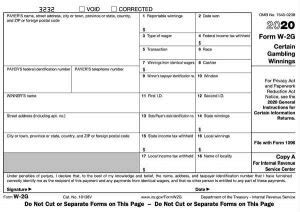

when does draftkings send out 1099 Sports Betting Taxes: How to Handle DraftKings, FanDuel IRS Form W-2G is an Internal Revenue Service document sent to gamblers to report their winnings and the amount that was withheld for taxes at the time of the payout. When you win, the entity paying you will issue you a Form W2-G, Certain Gambling Winnings, if the win is large enough. This form is similar to the 1099 form and serves as a record of your gambling winnings and as a heads-up to the IRS that you’ve hit the jackpot. You then must report all gambling winnings on your tax return.Does anyone know when they are going to send out the 1099s or has anyone received theirs yet? I filled out my W9 yesterday on draftkings. Im supposed to get my W2 some point next week and was going to file ASAP after. . The W9 info is just where they need to send that 1099 to.

When does DraftKings pay out? Learn more about when promotional credits arrive in your account — and when requested withdrawals land in your wallet. . DraftKings sends checks under $100 by .when does draftkings send out 1099The information provided by the player on the W-9 (name, social security number, and address) is used by DraftKings to populate IRS Forms W-2G and/or 1099-Misc. In the event your legal name, Social Security Number (SSN), or home address has changed, please fill out an updated W-9. Learn more about what is reportable to the IRS: Fantasy . Filling out Form W-9. Form W-9 is simple to fill out, and you won't have to send it to the IRS at all. Getting it to your client is enough. This form helps your clients fill out the 1099s they're required to send you. Essentially, a W-9 ensures they have all the information they need to fill out a 1099-NEC.

What better way to get through that challenging speed workout, three-hour long run, or hill sprint session than an awesome pump-you-up playlist of the best running songs? True, we all have different .

when does draftkings send out 1099|Sports Betting Taxes: How to Handle DraftKings, FanDuel